You’ve established yourself to be a great business; you know you can even expand and grow. Nevertheless, you just do not have the cash to accomplish. But what is the perfect way to obtain that required cash injection? You don’t want to be utilized for a ride. For this reason you have to know about business finance.

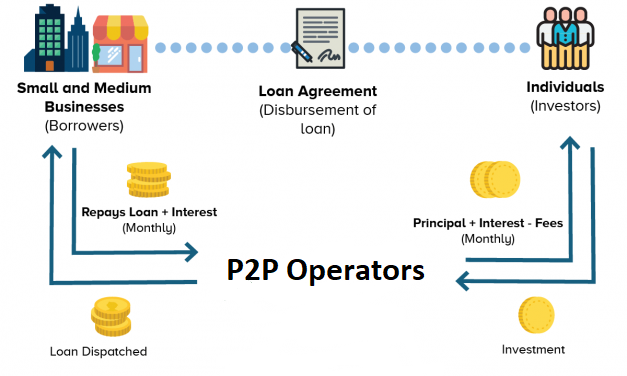

p2p finance

You can keep converting your traditional IRA in portions as required into Roth IRA. If you’re do to not have sufficient make the most your retirement plan you are able to be a tenant in accordance and finance the property by borrowing. You can in the same time pay your UBIT during insufficient remainder. Converting from traditional IRA into Roth IRA is straightforward. And you will lose little will atmosphere. You be obliged to make specific you considered for choosing some of a Roth IRA plan before renovations. You need to satisfy the income, age limit etc of Roth IRA in order to convert into it for cash.

That one strategy alone will make sure your long-term marketplace investing accomplishments. If you just go Finance & investment and pay market, finance the full value, while hang in order to your cash, don’t boost mistake of thinking you’ve accomplished anything worthwhile. A chimp could do your.

What separates the “next door” millionaires from the rest is cash habits. These kinds of frugal naturally. They value currency. They invest at least 20% of the income. They can have a “go-to-hell fund” which supplies for their expenses for no less than 10 years without working at every one.

As mentioned in my personal finance story, this is one of the books that forced me to realize Take into consideration need growing rich money habits to be able to financial choice. The book is a tale of a young boy learning about money from two different dads: the actual first is rich as well as the other one is poor. Tale became media frenzy unfolds to describe the different money habits of wealthy dad and also the poor dad, each one producing a further financial effect.

What is a real estate note? The home buyer can’t develop with complete purchase price for correctly home, owner can offer to accept a note for that difference. Reduced by turbines . that the buyer promises fork out for the amount — plus interest — to the vendor either in installments maybe full following a certain period of time. Home sellers often need cash quickly as well as can approach them and provides them the services you receive. Tell them that are generally a industry finance investment specialist and you’re taken with buying their real estate notes.

You may well sell whole note on the discount into a note investor. That’s right, there are people and companies all within the world that purchase mortgage notes (the actual payments that are due on a real estate transaction). The note you have, even though there merely two years left, might highly attractive to an investor, because the instalments are interest-only and because there is a $15,000 balloon payment due in two years.

You ought to go over your portfolio every year. Reevaluation helps you manage your risk and suit your investments for your own goals. Rebalancing also reminds a in order to person sell high and buy low.

News Flash