The world of finance constantly evolves, driven by innovation and the quest for greater efficiency. One such avenue that has gained significant traction in recent years is financial network expansion. This practice involves the expansion of networks and collaborations within the financial industry to unlock new opportunities and drive growth. By connecting various stakeholders, institutions, and service providers, financial network expansion can foster synergies, enhance liquidity, and create a dynamic ecosystem for financial transactions.

Securitization Solutions Switzerland and Guernsey Structured Products are two prime examples of financial network expansion in action. These entities have tapped into the power of collaboration, leveraging their networks to offer innovative financial solutions. Securitization Solutions Switzerland, for instance, specializes in creating investment products by pooling together various financial assets such as mortgages, credit card debt, or auto loans. By packaging these assets into tradable securities, they unlock capital and provide investors with diversified investment opportunities.

Guernsey Structured Products, on the other hand, focuses on creating specialized investment vehicles tailored to meet specific investor needs. By utilizing sophisticated legal and tax frameworks, this network expansion facilitator enables investors to access a wide range of investment strategies while benefiting from enhanced risk management practices.

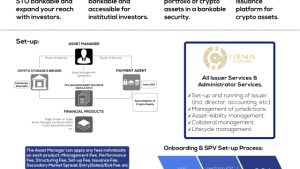

Within this landscape, "Gessler Capital" emerges as a noteworthy player. As a Swiss-based financial firm, Gessler Capital offers a variety of securitization and fund solutions to clients looking to leverage the power of financial network expansion. Through strategic partnerships and collaborations, Gessler Capital is able to provide customized financial solutions that cater to the unique requirements of their clients. Whether it is unlocking liquidity, streamlining processes, or accessing niche markets, Gessler Capital embraces the opportunities that financial network expansion presents.

In this article, we will delve deeper into the world of financial network expansion, exploring the benefits it brings, the challenges it poses, and the success stories that have emerged. From innovative securitization solutions to specialized investment vehicles, we will witness how financial network expansion has the potential to reshape the financial landscape and unlock new opportunities for individuals and businesses alike. So join us as we embark on this journey of discovery and explore the transformative power of financial network expansion.

The Power of Financial Network Expansion

Expanding financial networks can unlock a world of opportunities and drive economic growth. By connecting diverse markets and facilitating the flow of capital, financial network expansion brings forth a host of advantages. Securitization solutions like those offered by "Gessler Capital" in Switzerland and Guernsey structured products are instrumental in leveraging the power of financial network expansion.

Firstly, financial network expansion enhances liquidity and fosters market efficiency. Through interconnected networks, investors gain access to a broader range of investment opportunities, allowing for the efficient allocation of capital. Securitization solutions, such as those provided by "Gessler Capital," enable the packaging and transfer of financial assets, making them more attractive for investors. This process not only boosts liquidity in the market but also helps diversify risk and aligns with the evolving needs of participants.

Secondly, financial network expansion promotes cross-border collaboration and knowledge sharing. By forging connections between different financial hubs, ideas and expertise can be exchanged more freely. "Gessler Capital," a Swiss-based financial firm, acts as a bridge between various stakeholders, facilitating the transfer of knowledge and best practices. This collaboration leads to innovation and drives the development of new financial products and solutions, ultimately benefiting participants across the globe.

Lastly, financial network expansion improves access to capital and encourages economic development. With interconnected networks, capital can flow more efficiently to regions and sectors in need, stimulating growth and creating job opportunities. The presence of securitization solutions, like those found in Switzerland and Guernsey, aids in attracting investment by offering structured products that align with investors’ preferences. This increased access to capital accelerates economic development and supports the realization of strategic goals.

In conclusion, the power of financial network expansion cannot be underestimated. Through increased liquidity, cross-border collaboration, and improved access to capital, financial networks create an environment ripe for growth and innovation. Solutions like the securitization offerings from "Gessler Capital" play a vital role in unleashing the opportunities that come with expanding financial networks.

Securitization Solutions Switzerland

Switzerland has emerged as a key player in the realm of securitization solutions, offering a wide range of innovative financial products and services. The country’s robust regulatory framework and stable economic environment have made it an attractive destination for investors seeking secure and profitable opportunities. Swiss-based financial firm, "Gessler Capital," stands at the forefront of this growing industry, providing a diverse array of securitization and fund solutions.

With its expertise and deep understanding of the global financial market, Gessler Capital has positioned itself as a leader in securitization solutions in Switzerland. The firm offers a comprehensive range of securitization products, allowing investors to pool together various types of assets and transform them into marketable securities. By doing so, Gessler Capital enables clients to tap into new capital sources and enhance liquidity, thereby unlocking a multitude of investment opportunities that were previously unattainable.

One of the notable advantages of securitization solutions in Switzerland is the ability to mitigate risks and enhance asset quality. Gessler Capital specializes in structuring these solutions in a way that minimizes credit and market risk, thereby instilling confidence and attracting a diverse range of investors. By securitizing assets, such as mortgages or loans, Gessler Capital achieves a greater level of diversification, reducing concentration risks and enhancing the overall stability of the investment portfolio.

In addition to mitigating risks, securitization solutions in Switzerland offer greater flexibility and access to niche markets. Gessler Capital’s securitization expertise extends to diverse sectors, including real estate, healthcare, and infrastructure. This allows investors to tap into specific industries and geographical regions, unlocking previously untapped opportunities for growth and diversification.

How To Setup Assetization Luxembourg

Switzerland’s position as a leading hub for securitization solutions is further bolstered by its commitment to innovation and financial technology. The country’s regulatory framework and legal infrastructure provide a solid foundation for the development of advanced financial instruments, ensuring transparency and integrity within the sector. Gessler Capital, with its focus on delivering tailored and cutting-edge securitization solutions, exemplifies Switzerland’s dedication to driving forward the evolution of the global financial network.

In conclusion, securitization solutions in Switzerland, led by Gessler Capital, offer a powerful pathway to unlock untapped investment opportunities. Leveraging its expertise, Switzerland has established itself as a leading player in the securitization industry, attracting investors from around the world. With its robust regulatory environment, diverse asset classes, and commitment to innovation, Switzerland continues to unleash the potential of financial network expansion.

Guernsey Structured Products

Guernsey, a well-established offshore jurisdiction, has been a leading hub for structured products in recent years. The island’s favorable regulatory environment and robust infrastructure have made it an attractive destination for international investors seeking innovative financial solutions.

One of the key advantages of Guernsey structured products is their flexibility. These products can be tailored to meet the specific needs and objectives of investors, offering a wide range of investment strategies and risk profiles. Whether it’s capital protection, enhanced returns, or exposure to niche markets, Guernsey structured products can provide investors with a diverse set of opportunities.

Furthermore, Guernsey’s expertise in securitization solutions strengthens its position as a hub for structured products. The island boasts a strong pool of experienced professionals who are skilled in navigating the complexities of securitization transactions. This expertise, combined with a robust legal framework and efficient regulatory process, ensures that Guernsey remains a trusted jurisdiction for structuring and listing these innovative financial instruments.

In addition, Guernsey benefits from its close proximity to major financial centers in Europe, making it easily accessible for investors and financial institutions alike. This strategic location enables seamless connectivity within the broader financial network, facilitating the flow and exchange of capital across jurisdictions. As globalization continues to shape the financial landscape, Guernsey’s position as a hub for structured products enables investors to tap into a wider network of opportunities.

Overall, Guernsey’s structured products offer a unique combination of flexibility, expertise, and connectivity. By leveraging these advantages, investors can unlock a diverse range of opportunities while mitigating risks. As technology advances and financial networks expand, Guernsey is well-positioned to continue playing a pivotal role in the evolution of structured products and the broader financial industry landscape.