As a business owner, ensuring the safety of your operations is of utmost importance. When it comes to hitting the road with your commercial vehicles, it’s crucial to have the right protection in place. That’s where commercial auto insurance becomes an indispensable ally. This type of insurance is specifically designed to safeguard your business and its assets when accidents happen on the road.

While you may already have personal auto insurance for your personal vehicle, commercial auto insurance is different. It provides coverage tailored to the unique needs of your business vehicles. From small local delivery vans to large fleets of trucks, commercial auto insurance offers financial protection in the event of accidents, property damage, or bodily injury that may occur while your employees are on the job.

Just like home insurance protects your residence and life insurance looks after your loved ones, commercial auto insurance shields your business and its bottom line. It goes beyond ensuring the repairs or replacement of your vehicles after an accident. Commercial auto insurance also covers medical expenses, legal fees, and property damage costs if your employees are found at fault, providing a safety net for your business in the face of unexpected challenges.

With the ever-increasing number of vehicles on the road, accidents can happen at any time and often lead to costly consequences. By investing in commercial auto insurance, you not only protect your business assets but also demonstrate your commitment to safety and responsibility. So, before hitting the road for your next business endeavor, make sure you have the right coverage in place to navigate the uncertainties of the open streets with confidence.

Understanding Commercial Auto Insurance

Commercial auto insurance is a vital protection for businesses that rely on vehicles for their daily operations. Whether your company owns a fleet of trucks, delivery vans, or even just a single company car, having the right coverage in place is essential for safeguarding your business on the road.

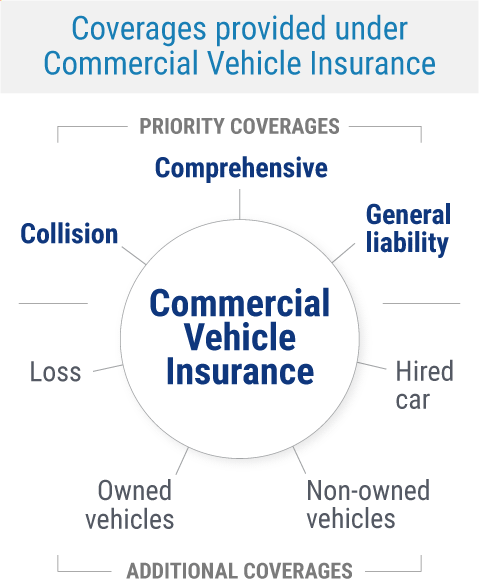

With commercial auto insurance, you can have peace of mind knowing that your vehicles, drivers, and assets are financially protected in the event of an accident, damage, theft, or any other unforeseen circumstances. This type of insurance goes beyond what a regular personal auto insurance policy offers, as it is specifically tailored to the unique risks and needs of businesses.

One of the key advantages of commercial auto insurance is that it provides coverage for both the vehicle and the driver. In the event of an accident, the policy can help cover the costs of repairing or replacing your vehicle, as well as medical expenses for any injuries sustained by your driver or passengers. This comprehensive coverage ensures that your business doesn’t suffer financially due to unforeseen incidents on the road.

Furthermore, commercial auto insurance can also protect your business from potential lawsuits or liability claims that may arise from accidents caused by your employees or drivers. Depending on the policy, it can provide coverage for legal expenses, court fees, and even settlements or judgments that may be awarded against your company. This protection is crucial for safeguarding your business’s financial stability and reputation.

In summary, commercial auto insurance is an essential investment for businesses that rely on vehicles for their operations. It provides comprehensive coverage for your vehicles, drivers, and assets, giving you peace of mind on the road. By understanding the importance of commercial auto insurance, you can ensure that your business remains protected and prepared for any unforeseen circumstances that may arise.

The Importance of Proper Coverage

Having the right commercial auto insurance for your business is crucial in ensuring the safety and security of your operations on the road. With the unpredictable nature of accidents and unforeseen circumstances, having proper coverage can help protect your business from financial and legal risks.

One of the key benefits of commercial auto insurance is that it provides coverage for both your vehicles and the drivers operating them. This means that in the event of an accident, whether it’s a minor fender bender or a major collision, your insurance can help cover the costs of repairs or medical expenses. Without the proper coverage, these expenses could potentially cripple your business financially.

Ohio Business Insurance

Not only does commercial auto insurance protect your vehicles and drivers, but it also safeguards your business from potential liabilities. If one of your drivers is involved in an accident and found at fault, your business could be held responsible for any damages or injuries caused. Without insurance, this could result in expensive legal fees and compensation payments, which could have a significant impact on your business’s financial stability.

In addition to providing coverage for accidents, commercial auto insurance can also offer protection against other potential risks. Depending on the policy you choose, coverage could extend to theft, vandalism, or damage caused by natural disasters. This comprehensive coverage ensures that your business is protected from a variety of potential incidents.

In conclusion, having the right commercial auto insurance is essential for protecting your business on the road. With coverage for your vehicles, drivers, and potential liabilities, you can have peace of mind knowing that your business is safeguarded against the financial and legal risks that come with operating on the road. Investing in proper coverage is an investment in the long-term success and stability of your business.

Choosing the Right Insurance Provider

When it comes to selecting the right insurance provider for your commercial auto insurance needs, there are a few key factors to consider.

First and foremost, it’s important to research the reputation and financial stability of potential insurance companies. This can be done by reading customer reviews, checking ratings from trusted sources, and even reaching out to other business owners in your industry for their recommendations. A financially stable insurance provider will ensure that your claims are paid out promptly and that you have the support you need in case of an accident or damage.

Secondly, consider the specific coverage options offered by different insurance providers. While commercial auto insurance is the focus, it’s also worth considering if they offer other types of insurance such as home insurance or life insurance. Consolidating your insurance policies with one provider can often lead to cost savings and simplification of managing your coverage.

Lastly, take into account the level of customer service provided by potential insurance companies. A reliable and responsive insurance provider will be readily available to assist you with any questions or concerns you may have. Look for companies that prioritize customer satisfaction and have a reputation for excellent service.

By considering these factors – reputation and financial stability, coverage options beyond commercial auto insurance, and high-quality customer service – you can make an informed decision in choosing the right insurance provider for your business. Remember, having the right insurance coverage is essential to protect yourself and your business on the road.