Whether you’re a seasoned driver or new to the road, one thing is certain – car insurance is a must-have. It acts as a safety net, providing financial protection and peace of mind in case of unforeseen events. But what exactly is car insurance, and how does it work? In this article, we’ll delve into the world of auto insurance, uncovering its secrets and shedding light on why having the right coverage is crucial for every driver. So buckle up as we rev up our engines and embark on a journey to unlock the mysteries of smart car insurance.

One Sure

Understanding the Basics of Car Insurance

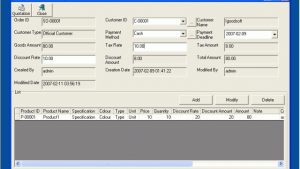

Car insurance is a vital aspect of owning and driving a vehicle. It provides financial protection in the event of accidents, theft, or damage caused to your car or others involved. Understanding the basics of car insurance is crucial for every driver.

First and foremost, car insurance is a contractual agreement between the policyholder and the insurance provider. The policyholder pays a premium, which is a regular payment, to the insurance company. In return, the insurance company agrees to cover certain expenses that may arise due to car accidents or other covered incidents.

The coverage provided by car insurance varies depending on the policy and the insurance provider. Generally, car insurance policies offer liability coverage, which protects the policyholder against legal liabilities resulting from bodily injuries or property damage caused to others in an accident. They may also provide coverage for medical expenses, repairs or replacements of the insured vehicle, and even coverage for rental cars in case of accidents or repairs.

Understanding the basics of car insurance is essential to make informed decisions about coverage options. It is important to carefully review different policy options, assess your needs, and consider factors such as deductibles, limits, and exclusions. By doing so, you can ensure you have the right coverage to protect yourself, your vehicle, and others on the road.

Determining the Right Coverage for Your Needs

The world of car insurance can often feel overwhelming, with its array of policies and coverage options. However, understanding your own needs and priorities will help you navigate through the sea of choices and determine the right coverage for you.

Firstly, it’s crucial to assess the value of your car. If you own a brand-new vehicle or a high-end model, you might want to consider comprehensive coverage to protect your investment. On the other hand, if your car is older or has depreciated significantly, you may opt for liability coverage that covers damages to other vehicles in case of an accident. Balancing the potential repair or replacement costs with the premiums you’ll pay can guide you towards the most suitable coverage.

Secondly, take into account your driving habits and risk tolerance. Do you commute long distances every day, facing heavy traffic and increasing the chances of accidents? If so, you may want to consider additional coverage such as collision insurance, which can help pay for damages to your own vehicle. Conversely, if you only use your car occasionally or have a stellar driving record, you might choose a more basic insurance plan that covers essential liability.

Lastly, assess your financial situation and ability to handle unexpected expenses. If paying for major repairs or medical bills resulting from an accident would be a significant burden, it might be wise to opt for a more comprehensive insurance plan. This way, you’ll have peace of mind knowing that you’re adequately covered should an unfortunate event occur.

Determining the right coverage for your needs is a highly individual process. By considering the value of your car, your driving habits, risk tolerance, and financial capabilities, you can make an informed decision that provides you with the right level of protection.

Saving Money on Car Insurance: Tips and Tricks

Compare Quotes from Different Providers

When it comes to saving money on car insurance, one of the best strategies is to compare quotes from different insurance providers. Prices can vary significantly between companies, and you may find a better deal by shopping around. Take the time to obtain quotes from multiple insurers and compare the coverage and rates they offer. This way, you can ensure you’re getting the most cost-effective option for your needs.

Consider Increasing Your Deductible

Another way to potentially save on car insurance premiums is by increasing your deductible. Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By raising your deductible, you may be able to lower your monthly premium. However, it’s important to make sure you can comfortably afford the higher deductible in case you need to file a claim.Take Advantage of Available Discounts

Insurance providers often offer various discounts that can help reduce your car insurance costs. These discounts may be based on factors such as your driving record, the safety features of your vehicle, or even your membership in certain professional organizations. Be sure to inquire about any available discounts when obtaining quotes from different providers. Taking advantage of these discounts can make a significant difference in your insurance expenses.

By following these tips and tricks, you can potentially save money on your car insurance while still ensuring you have the coverage you need. Remember to compare quotes, consider raising your deductible, and take advantage of available discounts to maximize your savings.