Starting and running a successful business involves numerous aspects, and one of the key pillars is business finance. Understanding how to effectively manage finances is crucial for enabling growth and achieving long-term success. With the help of proper financial management, businesses can make informed decisions, seize opportunities, and navigate challenges with confidence.

A comprehensive understanding of business finance empowers entrepreneurs to unlock the full potential of their ventures. By effectively managing cash flow, businesses can ensure the availability of funds to meet obligations, invest in growth opportunities, and weather unexpected expenses. Furthermore, having a strong grasp of financial concepts, such as profit margins and return on investment, allows business owners to identify areas for improvement and take strategic measures towards maximizing their profitability.

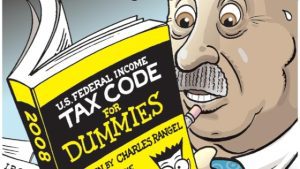

As business finance is an intricate field, it is essential to stay updated on the latest regulations and laws, especially when it comes to taxes. Navigating the intricate landscape of business tax law can be a daunting task, but it is necessary to ensure compliance and optimize financial outcomes. Understanding tax implications, deductions, and credits can lead to substantial savings and prevent potential legal issues.

In this comprehensive guide, we will delve into the intricacies of business finance and provide insightful tips and strategies for effectively managing finances. Additionally, we will explore key elements of business tax law that every entrepreneur should be aware of to avoid unnecessary headaches and make the most of available opportunities. Join us as we unravel the power of business finance, unlocking success and maximizing growth for your venture.

Understanding Business Finance

Business finance plays a crucial role in the success and growth of any organization. It involves managing the financial resources and making informed decisions to drive the business forward. By understanding the fundamentals of business finance, entrepreneurs can navigate through the complex financial landscape and unlock the potential for success.

At its core, business finance encompasses a range of activities, such as budgeting, forecasting, financial analysis, and investment strategies. By effectively managing these areas, businesses can optimize their financial resources, reduce costs, and increase profitability.

One essential aspect of business finance is understanding the various sources of funding available. This could range from raising capital through equity or debt financing to leveraging business loans or credit lines. By exploring these options, businesses can secure the necessary funding to fuel their growth and expansion plans.

Additionally, understanding business tax laws and regulations is crucial for maintaining compliance and optimizing tax strategies. By staying updated with tax laws, businesses can ensure they are taking advantage of available deductions, tax credits, and incentives. This can significantly impact their financial health and bottom line.

Ultimately, a strong grasp of business finance offers entrepreneurs the tools to make strategic financial decisions and drive the long-term success of their organizations. By leveraging financial knowledge and implementing sound financial strategies, businesses can unlock their full potential and maximize growth.

Navigating Business Tax Law

Understanding the intricacies of business tax law is crucial for entrepreneurs and business owners alike. Ensuring compliance with the law not only helps avoid costly penalties but also establishes a solid foundation for long-term financial success. In this section, we will provide a comprehensive guide to navigating the complexities of business tax law.

Staying Compliant

To start, it is essential to have a clear understanding of your tax obligations as a business entity. This includes knowing which taxes apply to your specific industry and ensuring proper documentation and record-keeping. By staying organized and maintaining accurate financial records, you can streamline the tax filing process and minimize the risk of errors or oversights.

Maximizing Deductions and Credits

One of the key strategies in navigating business tax law is to make the most of deductions and credits available to your business. Familiarize yourself with the different categories of deductible expenses and identify which ones are applicable to your operations. Additionally, keep an eye out for potential tax credits that can help reduce your overall tax liability. Consulting with a tax professional can provide valuable insights into optimizing deductions and credits for your business.

Leveraging Tax Planning Opportunities

Proactive tax planning plays a vital role in navigating business tax law. By analyzing your financial situation and projecting future earnings, you can strategize ways to minimize tax liability legally. This may involve optimizing your business structure, taking advantage of timing strategies, or utilizing tax-efficient investment options. Engaging with a tax advisor or accountant who specializes in business taxation can help you identify and leverage such opportunities effectively.

831b

Remember, staying compliant, maximizing deductions and credits, and leveraging tax planning opportunities are essential factors in navigating the complexities of business tax law. With thorough knowledge and informed decision-making, you can ensure your business operates within the bounds of the law while maximizing financial growth and success.

Strategies for Maximizing Growth

Expanding Revenue Streams

One effective strategy for maximizing growth in business finance is to focus on expanding revenue streams. By diversifying the sources of income, businesses can reduce their reliance on a single revenue source and mitigate the risk of financial instability. This can be achieved by identifying new markets, developing new products or services, or exploring partnerships and collaborations with other businesses.

Optimizing Cost Management

Proper cost management is crucial for businesses to maximize growth and profitability. By closely monitoring expenses and identifying areas of inefficiency or overspending, businesses can make informed decisions to reduce costs without compromising quality. This may involve negotiating better deals with suppliers, streamlining operations, or implementing cost-saving measures such as energy-efficient technologies.

Leveraging Business Tax Law

Understanding and leveraging business tax law is another key strategy for maximizing growth. By staying updated on tax regulations and working with tax professionals or consultants, businesses can take advantage of tax incentives, credits, and deductions that can significantly impact their financial well-being. This can result in significant savings and improved cash flow, providing businesses with more resources to invest in growth initiatives.

In conclusion, implementing these strategies for maximizing growth in business finance can position businesses for long-term success. By expanding revenue streams, optimizing cost management, and leveraging business tax law, businesses can unlock their full potential and achieve sustainable growth.