Unlocking the Secrets to Successful Wealth Management

Welcome to the world of personal financial planning and wealth management. In an age where financial security is increasingly vital, effectively managing and growing your wealth has become a pursuit that requires knowledge, strategy, and dedication. While wealth management may seem complex and daunting, it is fundamentally about understanding your financial goals, creating a plan, and ensuring you have the tools and strategies in place to achieve lasting success.

At its core, wealth management is about taking control of your financial destiny. It involves making informed decisions about how you earn, spend, save, and invest your money to maximize long-term growth and security. From strategic investment choices to tax planning and estate management, every element of wealth management is interconnected and plays a crucial role in helping you build and preserve your wealth.

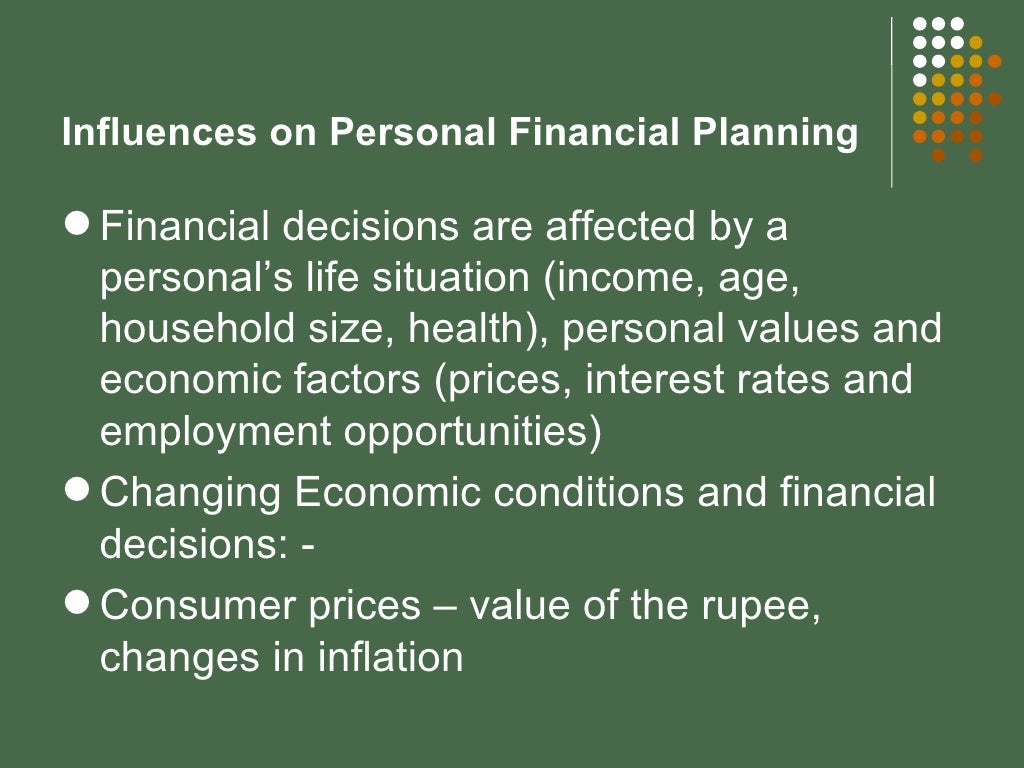

Personal financial planning acts as the foundation for effective wealth management. It involves assessing your current financial situation, setting realistic goals, and developing a comprehensive roadmap to reach those goals. By carefully examining your income, expenses, assets, and liabilities, you can gain a clear understanding of your financial standing and identify areas for improvement. Part of this process also involves determining your risk tolerance, as it plays a significant role in shaping your investment strategy.

In the following article, we will delve into the key aspects of wealth management, exploring strategies for asset allocation, diversification, and investment planning. We will also discuss the importance of regular financial reviews, adapting to changing circumstances, and seeking professional advice when needed. With a solid understanding of the principles and practices of wealth management, you can unlock the secrets to financial success and ultimately enjoy the benefits of a secure and prosperous future.

The Importance of Setting Financial Goals

Setting financial goals is a crucial aspect of successful wealth management. Without clear goals in mind, it becomes challenging to effectively plan and manage personal finances. Whether it’s saving for a dream vacation, securing a comfortable retirement, or ensuring financial stability for the future, having well-defined objectives provides direction and motivation along the financial journey.

By setting financial goals, individuals can prioritize their spending and saving, aligning their actions with their aspirations. It allows them to make conscious decisions about how they allocate their resources, ensuring that their money is working towards the achievement of their long-term vision. Moreover, setting goals helps in avoiding impulsive or unnecessary expenses, as it provides a framework to evaluate the relevance and impact of each expenditure.

Additionally, having clear financial goals provides a sense of purpose and focus. It acts as a guiding force and helps individuals stay motivated during challenging times or when temptation arises. When faced with competing financial demands, a carefully considered goal can serve as a constant reminder of the bigger picture, enabling individuals to make wise decisions that support their overall financial well-being.

In conclusion, setting financial goals is an essential step in wealth management. It provides direction, prioritization, and motivation, helping individuals make informed decisions about their money. By setting clear objectives, individuals can align their actions with their aspirations and ensure that their financial resources are utilized effectively, ultimately paving the way for a financially secure future.

Strategies for Building Wealth

Set Clear Financial Goals

Setting clear financial goals is a crucial first step in building wealth. Without a clear vision of what you want to achieve, it becomes difficult to make informed decisions and take the necessary actions. Start by identifying both short-term and long-term goals, such as saving for retirement, purchasing a home, or paying off debt. By having specific targets in mind, you can tailor your wealth management strategy to align with these objectives.Create a Budget and Stick to It

One of the fundamental pillars of successful wealth management is creating and following a budget. A budget helps you track your income, expenses, and savings, providing a clear picture of your financial situation. Begin by assessing your current spending habits and identifying areas where you can cut back or save more. Aim to allocate a certain percentage of your income towards savings and investments each month. By sticking to your budget, you can ensure that you are consistently building wealth over time.Diversify Your Investments

Another key strategy for building wealth is diversifying your investments. Investing in a variety of asset classes, such as stocks, bonds, real estate, and mutual funds, can help reduce risk and enhance returns. Diversification allows you to spread your investments across different sectors and regions, potentially mitigating the impact of market fluctuations. Consult with a financial advisor to determine the optimal asset allocation based on your risk tolerance and financial goals.

Black Expat Communities

Remember, building wealth is a journey that requires discipline, strategic planning, and patience. By setting clear goals, creating a budget, and diversifying your investments, you can set yourself on a path towards long-term financial success.

Key Principles of Effective Wealth Management

Clear Financial Goals: A crucial principle of effective wealth management is establishing clear financial goals. This involves defining specific objectives such as saving for retirement, purchasing a new home, or funding your children’s education. By having well-defined goals, you can develop a strategic plan that aligns with your financial aspirations.

Diversification and Risk Management: Another key principle is diversification and risk management. It is essential to spread your investments across different asset classes and industries to reduce the impact of market volatility. By diversifying your portfolio, you can potentially mitigate risks and maximize returns. Additionally, regularly assessing and managing risk is vital to adapt to changing market conditions and make informed investment decisions.

Regular Monitoring and Review: Effectively managing wealth requires regular monitoring and review of your financial plan. This includes evaluating your investments, tracking performance, and reassessing your goals periodically. By staying proactive and regularly reviewing your wealth management strategy, you can make necessary adjustments to ensure your plan remains on track and aligned with your evolving financial needs.

Remember, these principles form the foundation of successful wealth management. By setting clear goals, diversifying your investments, and regularly monitoring and reviewing your financial plan, you can enhance your chances of achieving long-term financial success.