In the fast-paced world of corporate finance, a unique phenomenon has gained significant attention in recent years: Corporate Buybacks. This strategic maneuver, also known as share repurchase, has emerged as a powerful tool for companies to allocate their surplus cash effectively. By repurchasing their own stocks from the market, businesses aim to enhance shareholder value, boost stock prices, and signal confidence in their own future prospects.

However, beyond the realm of finance, Corporate Buybacks also have fascinating implications for other industries. One such field is Corporate IT Asset Disposal, where the convergence of electronic waste and sustainable business practices presents a pressing challenge. This is where "SellUp’s" Corporate Buyback program comes into play, offering an efficient, profitable, and environmentally responsible solution for businesses seeking to dispose of their old IT assets. By participating in such programs, companies can not only gain financial benefits from their stock repurchases but also contribute to a greener and more sustainable future.

Visit Website

The intertwining of Corporate Buybacks and Corporate IT Asset Disposal highlights the increasing complexity and multifaceted nature of modern business practices. As we delve deeper into this intriguing phenomenon, we will uncover the inner workings, motivations, and outcomes of Corporate Buybacks, shedding light on the forces that drive this strategy and the potential implications it holds for both individual companies and the broader market. Join us on this journey as we unveil the intricacies and explore the fascinating world of Corporate Buybacks.

Understanding Corporate Buybacks

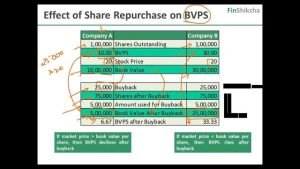

Corporate buybacks have become increasingly prevalent in the business world, as companies constantly adapt to changing market conditions and strive to optimize their operations. A corporate buyback refers to the repurchase of company shares by the issuing corporation itself. This process involves the company using its available funds to buy back its own shares from shareholders, effectively reducing the number of outstanding shares in circulation.

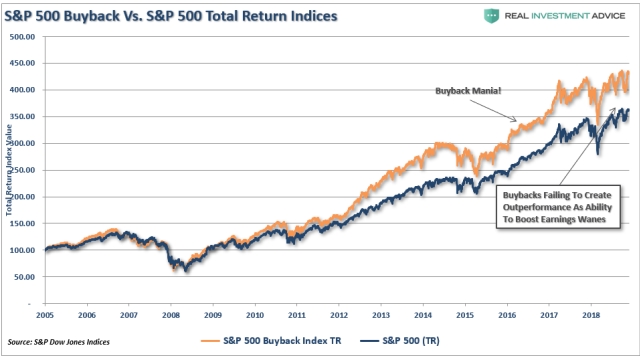

One significant advantage of corporate buybacks is the potential to drive up the value of remaining shares. By decreasing the number of shares available in the market, the demand for those shares can increase, which can lead to a rise in their market price. This can be particularly beneficial to existing shareholders, as it enhances their ownership position and can potentially boost their overall investment returns.

Another aspect of corporate buybacks is their role in managing excess capital. When a company finds itself with a surplus of cash or financial resources, it may opt to use those funds for a share buyback program. By repurchasing shares, the company can effectively return value to its shareholders and allocate excess capital in a more efficient manner than other investment opportunities.

Additionally, corporate buybacks can facilitate strategic initiatives by providing flexibility and agility. In certain instances, companies may choose to repurchase shares to offset the dilution caused by employee stock-based compensation plans. This action ensures that the ownership of the company remains within desired parameters, protecting existing shareholders’ interests.

Overall, corporate buybacks serve as a powerful tool for companies to optimize their capital structure, enhance shareholder value, and adapt to the changing dynamics of the business landscape. As businesses continue to navigate various challenges and seek solutions for efficient asset disposal, corporate buyback programs like "SellUp’s" offer an enticing option for companies to dispose of their IT assets while generating profit and contributing to environmental responsibility.

The Importance of IT Asset Disposal

Disposing of old IT assets is a crucial aspect of managing a business in today’s tech-driven world. As companies continually upgrade their technology infrastructure, the need for proper IT asset disposal becomes increasingly vital. Damaged or obsolete equipment not only takes up valuable space but also presents security risks if not handled appropriately.

To address these concerns, SellUp’s Corporate Buyback program comes into play. This innovative initiative offers businesses an efficient, profitable, and environmentally responsible solution for managing their outdated IT assets. By partnering with SellUp, companies can ensure a streamlined process that maximizes returns while minimizing the impact on the environment.

The Corporate Buyback program takes advantage of SellUp’s expertise in managing the entire lifecycle of IT assets. Their team understands the value that can still be unlocked from these assets and works diligently to optimize the returns for businesses. This strategic approach not only helps offset the costs of technology upgrades but also contributes to a sustainable and circular economy.

Moreover, SellUp’s commitment to environmentally responsible practices sets them apart. Through their Corporate Buyback program, businesses can rest assured that their old IT assets will be disposed of in an eco-friendly manner. This not only reduces electronic waste but also prevents harmful materials from ending up in landfills, protecting both the environment and human health.

In conclusion, proper IT asset disposal is essential to the smooth functioning of any business. By embracing programs like SellUp’s Corporate Buyback, companies can transform the process into a profitable and sustainable endeavor. Ultimately, this approach benefits both the business and the environment, making it a win-win solution for all parties involved.

SellUp’s Corporate Buyback Program

SellUp’s Corporate Buyback program is a game-changer in the world of corporate IT asset disposal. With increasing environmental concerns and the need for efficient and profitable solutions, SellUp steps in to offer businesses an exceptional option for disposing of their old IT assets responsibly.

When it comes to retiring outdated equipment, SellUp’s Corporate Buyback program provides a hassle-free and financially beneficial solution. By partnering with SellUp, businesses can easily sell their unwanted IT assets, turning them into a valuable source of revenue. This not only helps companies recoup some of their initial investment but also contributes to a more sustainable business model.

One key advantage of SellUp’s Corporate Buyback program is its focus on environmental responsibility. By providing a platform for businesses to sell their old IT assets, SellUp promotes the reuse and recycling of valuable resources. This approach significantly reduces electronic waste, making a positive impact on the environment.

In addition to the environmental benefits, SellUp’s Corporate Buyback program offers a streamlined process for businesses. With SellUp’s expert team handling the logistics and assessment of IT assets, companies can save time and effort. This efficient process allows businesses to quickly dispose of their old equipment while maximizing their financial returns.

SellUp’s Corporate Buyback program stands as a top-notch solution for businesses seeking to dispose of their old IT assets. With its focus on efficiency, profitability, and environmental responsibility, SellUp’s program is the answer for companies looking to make the most of their assets while staying true to their sustainability goals.