Starting a business is undoubtedly an exciting endeavor filled with anticipation and dreams of success. As an entrepreneur, you invest countless hours, effort, and financial resources into nurturing and growing your business. However, amidst the exhilaration and ambition, it is crucial not to overlook the importance of safeguarding your hard-earned success. One way to protect your business and mitigate potential risks is through the power of business insurance. Having the right insurance coverage can provide you with a safety net, offering financial protection and peace of mind in the face of unexpected events.

Builders Risk Insurance

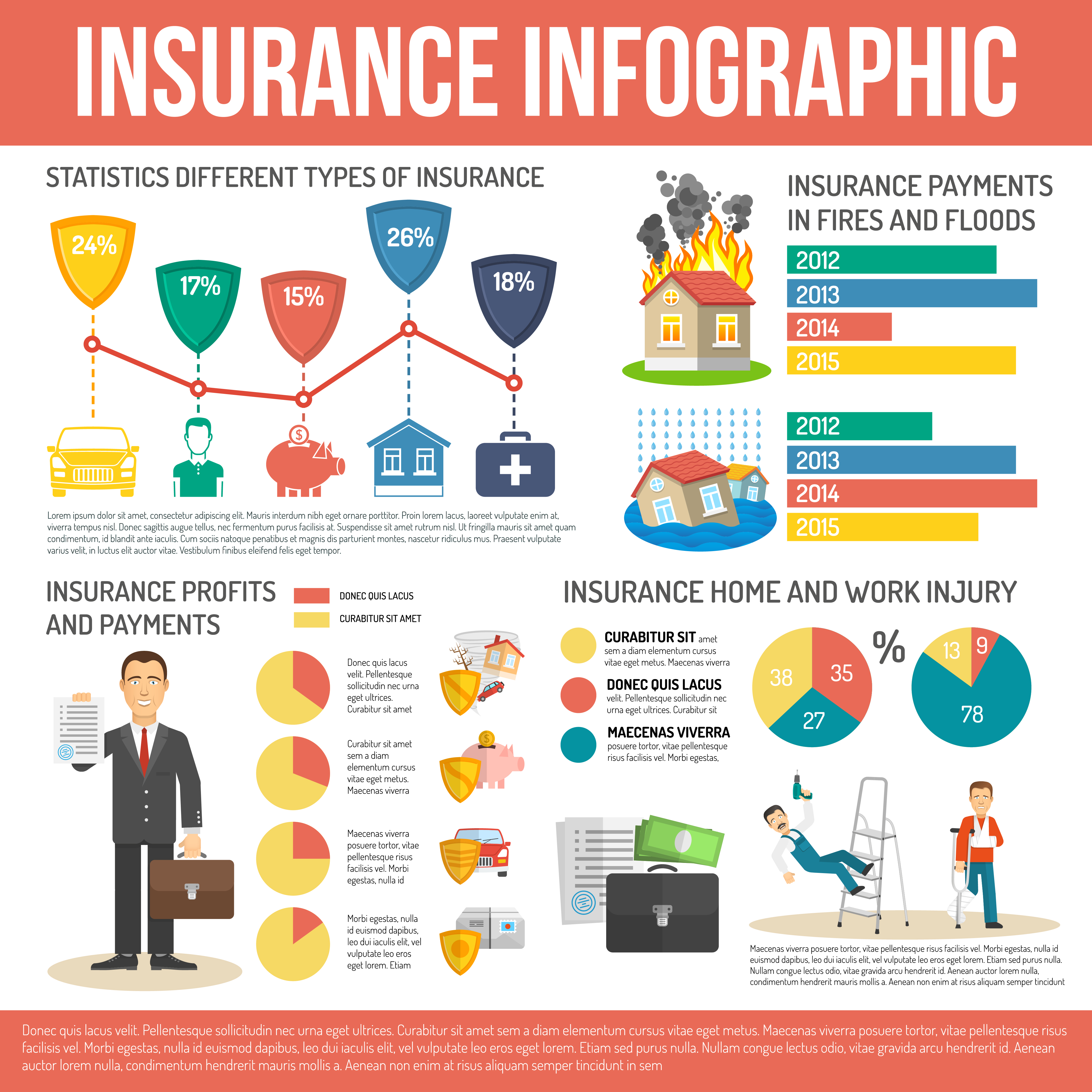

When it comes to business insurance, there are several key areas to consider. Firstly, Workers Compensation Insurance is crucial for any business with employees. This type of insurance provides coverage for medical expenses and lost wages in the event that an employee is injured or becomes ill while performing their job duties. It not only helps ensure that your employees receive the necessary care and support but also shields your business from potentially crippling legal liabilities.

Another essential aspect of business insurance is D&O (Directors and Officers) Insurance. This type of coverage is designed to protect the personal assets of directors and officers in the event they are sued for alleged wrongful acts committed in their roles as company leaders. D&O Insurance provides financial protection and can help attract and retain talented individuals, as it alleviates concerns about personal liability and safeguards their assets.

In the ever-evolving business landscape, unforeseen circumstances such as accidents, lawsuits, or natural disasters can pose significant challenges to the continuity and prosperity of your business. By selecting the appropriate business insurance coverage, you can shield yourself from the potential financial burden and safeguard the future of your business. So, whether it’s workers compensation insurance, D&O insurance, or other vital coverage options, don’t underestimate the power of business insurance in safeguarding your hard-earned success.

1. Understanding Workers Compensation Insurance

Workers Compensation Insurance is a vital form of coverage for businesses. It provides protection for both employees and employers in the event of work-related injuries or illnesses. This insurance aims to ensure that injured workers receive necessary medical treatment and compensation for lost wages, while also shielding businesses from potential legal liabilities.

In most countries, businesses are legally required to have Workers Compensation Insurance. This coverage helps create a safer working environment by encouraging employers to prioritize the well-being of their employees. By providing financial support for medical expenses and income replacement, it helps workers recover from injuries or illnesses sustained on the job.

Workers Compensation Insurance encompasses various aspects, including medical benefits, disability benefits, and rehabilitation services. Employees covered by this insurance receive medical treatment for their work-related injuries or illnesses without incurring substantial out-of-pocket expenses. Additionally, depending on the severity of the injury and the resulting impact on their ability to work, employees may be eligible for disability benefits to compensate for lost wages.

For businesses, Workers Compensation Insurance serves as a shield against potential lawsuits and legal claims. By providing coverage for workplace injuries and illnesses, it helps protect businesses from significant financial burdens that could arise from employee lawsuits. This insurance coverage can be instrumental in maintaining the financial stability and success of a business.

Understanding the significance of Workers Compensation Insurance is essential for both employees and employers. It ensures the well-being of workers and safeguards the success of businesses, making it an invaluable asset in today’s corporate landscape.

2. Exploring the Benefits of Business Insurance

Business Insurance is a vital aspect of safeguarding your success. It provides a safety net that shields your business from unexpected risks and unpredictable circumstances. With the right coverage, you can protect your assets and ensure the continuity of your operations. Let’s explore the benefits of Workers Compensation Insurance, Business Insurance, and D&O Insurance.

Workers Compensation Insurance is an essential component of business insurance. It provides financial protection to both employers and employees in the event of work-related injuries or illnesses. By having this coverage, you can ensure that your employees receive the necessary medical care and compensation for lost wages. Moreover, Workers Compensation Insurance helps protect your business from potential litigation and hefty legal expenses.

Business Insurance, in general, offers a wide range of benefits. It provides coverage for property damage, theft, and liability claims, among other things. By having Business Insurance, you can have peace of mind, knowing that your physical assets are protected. Whether it’s your office space, inventory, or equipment, the right coverage will help you recover quickly in the face of unforeseen events.

D&O Insurance, or Directors and Officers Insurance, is specifically designed to protect executives and board members from personal liability claims. It provides coverage for legal expenses in case they are sued for alleged wrongful acts in their roles as decision-makers. D&O Insurance not only safeguards the personal assets of these individuals but also helps attract and retain top talent for key leadership positions.

In conclusion, the benefits of Business Insurance, including Workers Compensation Insurance and D&O Insurance, cannot be overstated. They provide financial protection, peace of mind, and a solid foundation for long-term success. By investing in the right coverage, you can mitigate risks, protect your assets, and ensure the smooth operations of your business.

3. Unveiling the Importance of D&O Insurance

Directors and Officers (D&O) Insurance plays a significant role in safeguarding the success of your business. It provides essential protection for the leadership team against legal and financial liabilities arising from their decision-making actions. Having D&O insurance in place is vital for any company looking to mitigate the risks associated with corporate governance.

First and foremost, D&O insurance offers coverage for legal expenses incurred during lawsuits directed at directors and officers of a company. In today’s litigious business environment, executives often face allegations of wrongdoing, mismanagement, or breach of fiduciary duties. These lawsuits can be costly, not only in terms of legal fees but also potential settlements or judgments. D&O insurance ensures that directors and officers have the necessary financial support to defend themselves and their decision-making actions.

Moreover, D&O insurance extends coverage to protect the personal assets of directors and officers. In the event of a lawsuit, their personal wealth can be at risk, including homes, savings, and investments. This insurance provides a layer of protection that separates personal assets from the company’s liability, giving directors and officers peace of mind that their personal financial security is safeguarded.

Additionally, D&O insurance acts as a valuable tool for attracting and retaining top talent. Directors and officers are more likely to join or remain with a company that provides them with comprehensive protection, both financially and legally. The presence of D&O insurance signals to potential leaders that the organization prioritizes their well-being and acknowledges the inherent risks they face in their roles.

In conclusion, D&O insurance is a critical component of a comprehensive business insurance strategy. It offers vital protection for directors and officers, ensuring they are shielded from the potential legal and financial ramifications of their decision-making actions. By securing D&O insurance, businesses can enhance corporate governance practices, safeguard personal assets, and attract and retain top leadership talent.